Auto Insurance in and around Santa Fe

The first choice in car insurance for the Santa Fe area.

Take a drive, safely

Would you like to create a personalized auto quote?

Be Ready For The Road Ahead

State Farm isn't afraid of the unexpected, and with our fantastic coverage, you don't have to be either. With numerous options for coverage and savings, you can be sure to choose a policy that fits your specific needs.

The first choice in car insurance for the Santa Fe area.

Take a drive, safely

Navigate The Road Ahead With State Farm

With State Farm, get revved up for great auto coverage and savings options like non-owned auto coverage liability coverage, an older vehicle passive restraint safety feature discount Steer Clear®, and more!

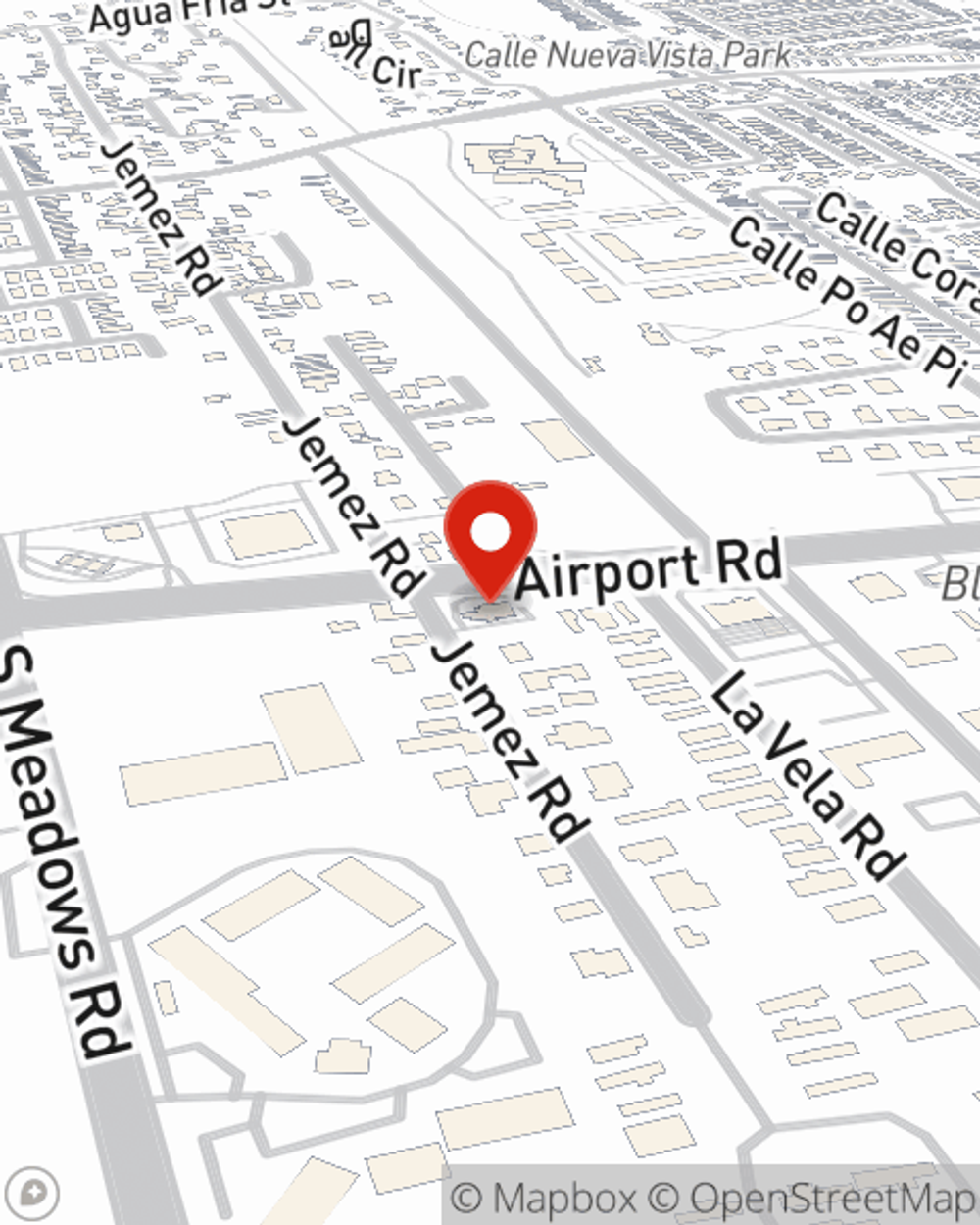

Contact agent Jairo Gutierrez's office to explore how you can benefit from State Farm's auto insurance.

Have More Questions About Auto Insurance?

Call Jairo at (505) 471-0308 or visit our FAQ page.

Simple Insights®

Use less gas with these fuel efficiency tips

Use less gas with these fuel efficiency tips

You can improve fuel efficiency and save money at the pump with these simple driving tips.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.

Jairo Gutierrez

State Farm® Insurance AgentSimple Insights®

Use less gas with these fuel efficiency tips

Use less gas with these fuel efficiency tips

You can improve fuel efficiency and save money at the pump with these simple driving tips.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.